Despite ICBC’s aggressive advertising campaigns and the savvier methods the RCMP are employing to bust distracted drivers across the country, people still continue to flirt with danger by using their smartphones and other electronic devices while they are behind the wheel.

As dangerous as this is, it’s also very expensive—it’s not just costing people the fines (now set at $543 for a first offence), it’s costing us all in the form of rising insurance premiums.

At SeaFirst Insurance we get a lot of questions regarding the seriousness of distracted driving fines and penalties. Many people are shaken up by the financial burden of it all, and are left wondering if the hefty fines extend to their future insurance rates.

“Does a distracted driving charge effect my safe driver’s discounts?”

This is a common question we hear.

The short answer is, no. Not immediately. But collectively, it might.

Let’s take a closer look at distracted driving charges and how intricately ICBC treats them.

What Counts as Distracted Driving in BC?

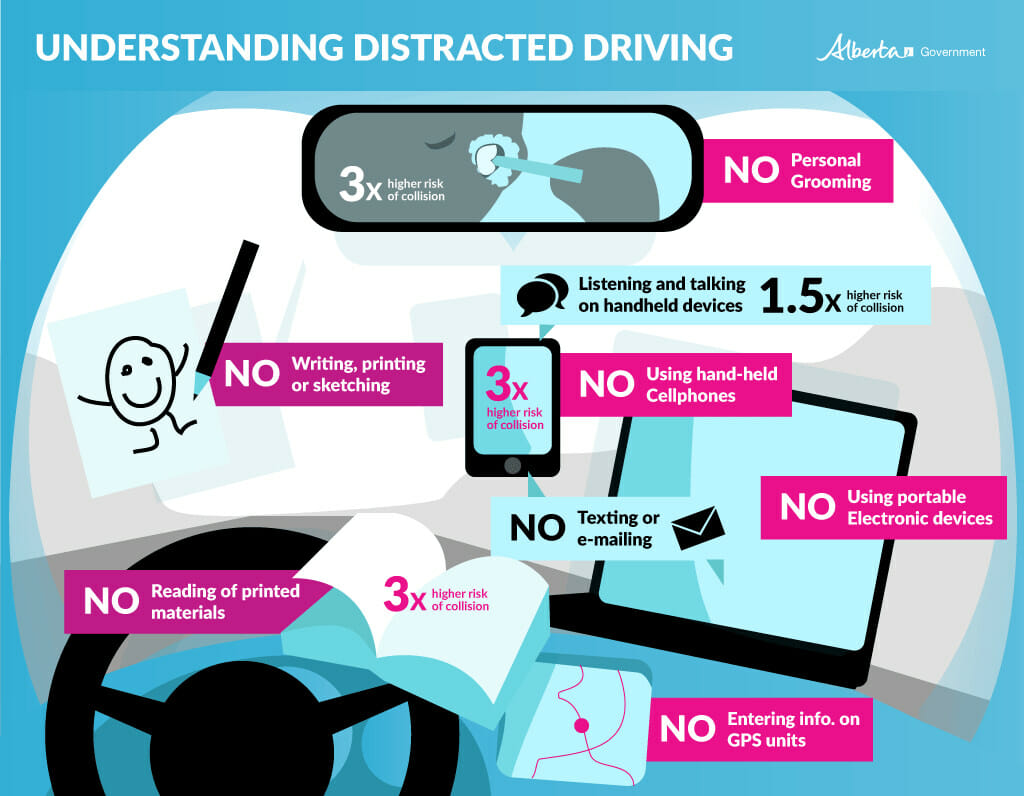

To start off with, we need a good explanation of what ‘distracted driving’ even means. For this we turn straight to the RCMP for a clear definition of what constitutes distracted driving:

“Distracted driving is a form of impaired driving as a driver’s judgment is compromised when they are not fully focused on the road.”

Examples include:

- Talking on a cell phone

- Texting

- Reading (e.g. books, maps, and newspapers)

- Using a GPS

- Watching videos or movies

- Eating/drinking

- Smoking

- Personal grooming

- Adjusting the radio/CD

- Playing extremely loud music

This is a nit-picky list—as most of us are aware, the true concerns are the top two bullets. In other words, leave your phone alone!

How much does a distracted driving ticket cost in BC?

If you are caught texting, emailing or holding a cellphone or other hand-held electronic device while driving—and it’s your first offence—you’ve got to pay a few ways.

First, you’ll owe the RCMP the standard fine of $368, then you’ll owe ICBC another $175 to take care of the four penalty points they will be adding to your driving record via the Driver Penalty Point premium.

Next, if it can be proven that your actions endangered others on the road while you were distracted, you could be charged with careless driving or dangerous driving under the Criminal Code. Stiffer fines and penalties will apply on top of the distracted driving ticket.

How a Distracted Driving Ticket Affects Insurance Premiums

There are six main factors ICBC uses to determine an individual’s insurance premiums:

- How you use your vehicle

- Where you live

- Your claims history

- The type of your protection you want

- Your desired deductible levels

- The type of vehicle you drive

You’ll notice in the list above that being ticketed for distracted driving does not affect your annual insurance rates. So, if you have years and years of safe driver discounts saved up, they stay put even though you’ve been ticketed. You actual annual insurance rates don’t go up.

Phew!

Now for the complicated part: Each traffic ticket handed down by the RCMP in British Columbia comes with Driver Penalty Points on your driving record that you inevitably must pay to get rid of. Some points you pay once to get rid of (Driver Penalty Point Premiums), others come back to haunt you year after year (Driver Risk Premiums).

It’s important to note that each of these points systems are separate from Autoplan insurance premiums. This means that they are billed even if you don’t own or insure a vehicle.

The long and short of it is, if you get a distracted driving ticket, you’re going to be owing the province of BC a lot of money in the long run—it just won’t be in the form of increased insurance premiums.

However, this isn’t sometime to celebrate…

Insurance Premiums Are on the Rise, Regardless

It’s no secret that across the board, insurance premiums in British Columbia are rising (for some drivers the rates are rising at about the same rate as drivers are earning safe driving discounts, meaning they see no difference in how much they owe year after year).

ICBC cites a few reasons for rising insurance rates, including:

- More crashes – Distracted driving is responsible for approximately one quarter of all fatal crashes in BC, which has significantly added to the grand total of car crashes.

- More claims – The cost of settling injury claims has risen to $2.4 billion in 2015. This figure is up by $900 million (60%) over the last seven years.

- More expensive vehicle repair costs – Vehicles today are high tech and there are a lot of newer cars on the road as more and more people qualify for financing.

So, in terms of the future, it is believed that the more incidents of distracted driving there are out there, the most accidents that are likely to occur, and the more accidents that occur, the higher the insurance rates must rise. Try explaining this to your family or friends the next time they decide to gamble on the roads.

Or if it’s easier, just swap your social media profile pic for a while. For the month of September, ICBC has initiated a distracted driving campaign to further drive home their message: Let’s make BC distraction free!

To participate, all you have to do is change your social media profile picture to the Not While Driving image (above). In doing so, you’ll be encouraging others to leave the phone alone behind the wheel.

Excuses, Excuses

In its Distracted Drivers and Cell Phone Use memo, ICBC goes to work dispelling common misconceptions regarding distracted drivers. Check out the highlights:

“I can call or text when I’m stopped at a red light.”

Nope. Even when you’re stopped at an intersection or slowed in traffic, you’re still considered to be driving.

“I’m a good driver so I can multitask.”

While it might seem like driving is second nature to you by now, experienced drivers are never prepared for the unexpected if they are constantly looking away from the road.

“It’s OK to use some of the other features on my phone while driving.”

Maybe you think you’re safe because you weren’t texting, but looking up an address or your favourite song also count as distracted driving. The rule makers can see you’re on the phone—not necessarily what you’re using it for.

“The law is the same for all drivers.”

Almost. Drivers in the Graduated Licensing Program are restricted from even using hands-free electronic devices.

“Using the speakerphone is allowed.”

Yes and no. To use the speakerphone, the phone has to be securely attached to either you (such as with a belt clip or in your pocket) or to the car; you can’t have it in your lap or loose on the seat beside you.

At the end of the day, the message is clear: leave your phone alone! Keep it out of sight, out of mind. Plan ahead to get to your destination, and check your messages when you’re good and parked.

If you’ve got questions on your distracted driving penalties, or any other questions relating to auto insurance in the Victoria, British Columbia, region, come see us at SeaFirst Insurance Brokers. At SeaFirst, you’ll never feel rushed and we’ll do our best to make sure all your questions are answered so you end up with the best coverage to suit your automotive insurance needs.