You’ve probably heard your broker use the phrase “We’re in a hard market”. But, what does it mean and why does it matter?

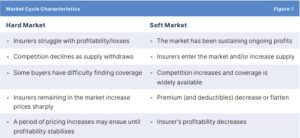

A hard market is when there are less competitors, resulting in fewer options for brokers to place your needs with. As mentioned in an earlier blog “What does an Insurance Broker really do?” Brokers match buyer needs to a product. Fewer markets means less options to match the buyer needs to. Less options usually results in higher premiums. Typically, what triggers a hard market (reduction in options) are events that cause substantial loss and instability for insurance companies. Effectively reducing their capacity and ability to tolerate risk.

Once stabilized, hard markets are followed by soft markets. Soft markets are the opposite of hard markets. They are characterized by more competition, resulting in more options for the broker to place your coverages with. There are stable profits, resulting in greater capacity and ability to tolerate risk.

Below is a comparison chart of hard and soft markets created by the British Columbia Financial Services Association.

Source: BCFSA 2020

BCFSA (2020). Strengthening Foundations: A report on the State of Strata Property Insurance In British Columbia. Retrieved from https://www.bcfsa.ca/pdf/news/StrataReport2020.pdf